Article 2 of the WTO Anti-dumping Agreement provides for provision regarding determination of dumping. As per Article 2.1, a product is considered as being dumped if the export price of the product is less than the normal value. Article 2.1 of the Anti-dumping Agreement provides that domestic selling price of like article in the exporting country shall be considered as normal value. However, Article 2.2 allows the investigating authority of a country to reject domestic prices for the purposes of calculating normal value in the event that the domestic sales of the like product do not permit a proper comparison because they are (i) not in the ordinary course of trade; (ii) are low in volume; or (iii) affected by ‘particular market situation’. If any one of these situations is established regarding the domestic sales price of the product, the investigation authority can opt for alternative methods of determination of normal value.

Australia imposed anti-dumping duty on the import of A4 copy paper from Indonesia on 18th April 2017. Australian Anti-dumping Commission (“ADC”) found that a market situation existed in the Indonesian A4 copy paper market because of strong influence on raw material inputs. Therefore, the ADC determined that the domestic sales under such a market situation were not suitable for use in determining normal value. Indonesia challenged this aspect of the ADC determination, among others, before the WTO DSB. Panel Report was issued in this case on 4th December 2019. [see endnote 1]

‘Particular market situation’ under Article 2.2 of the Anti-dumping Agreement had not been interpreted by any previous WTO Panel or Appellate Body. However, the concept of ‘particular market situation’ existed in pre-WTO Tokyo Round Anti-Dumping Code. In EEC-Cotton Yarn, the GATT Panel interpreted ‘particular market situation’ under Article 2.4 of the Tokyo Round Code to observe that it was “only relevant in so far as it had the effect of rendering the sales themselves unfit to permit a proper comparison.” [see endnote 2]

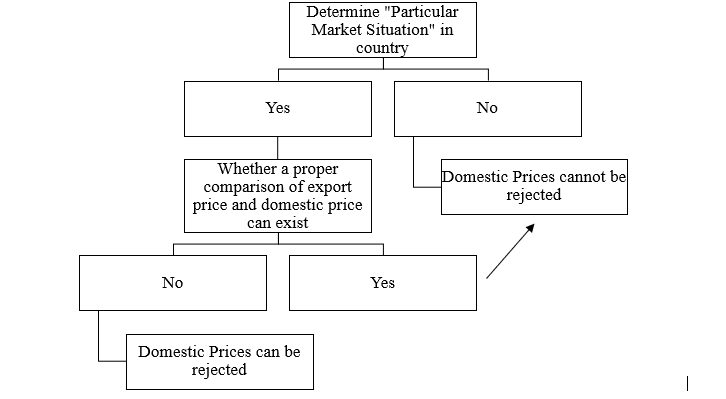

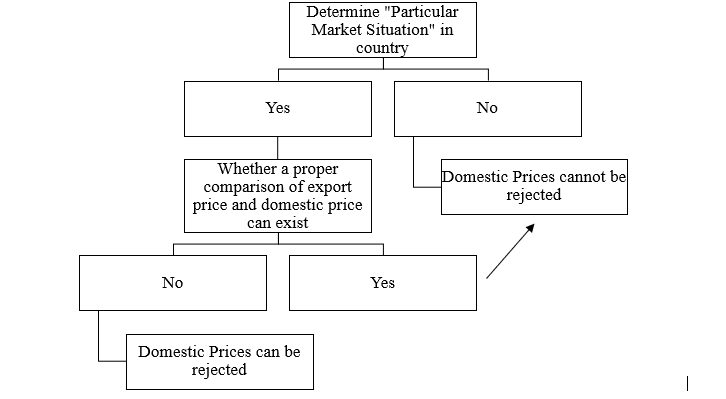

The Panel Report issued in Australia — Anti-Dumping Measures on A4 Copy Paper also stressed that mere existence of a ‘particular market situation’ in a country is not sufficient to reject domestic prices. Investigating Authority is required to examine whether ‘a proper comparison’ between domestic and export price is permitted or not. Only if a proper comparison cannot be made because of existence of ‘particular market situation’, can the investigating authority reject the domestic prices.

The Panel concluded that a ‘particular market situation’ is when there exists a unique set of circumstances relating to the market. The Panel refrained from assigning a more specific meaning to the term, since the Panel observed that analysis must be made on a case-to-case basis.

Panel held that distortion of raw material prices arising from government action can result in a particular market situation and therefore determination regarding ‘Particular Market Situation’ by ADC was consistent with Article 2.2. However, the Panel observed that the rejection of domestic prices was not warranted, since ADC did not establish the lack of comparability between domestic and export price of like product i.e. A4 copy paper.

Following diagram is illustrative to summarize the observation of the Panel:

When can the ‘domestic prices’ and ‘export prices’ be considered as incomparable?

The Panel found that the relative effect of the existing particular market situation on domestic and export price must be examined. A simplistic understanding limited to whether the ‘impact’ of the market situation extends to both domestic and export price is not sufficient. The Panel notes that even in a situation that both domestic and export prices are impacted, the level and nature of such impact may differ. Therefore, the assessment would not only require a numerical assessment of the prices, but also a holistic qualitative assessment.

The Panel went on to hold that no blanket rule can be constructed for the purposes of examination, since the approach would depend on the factual matrix of each case. For example, in the present case, Indonesia argued that the input costs were distorted for products which are sold in the domestic markets, as well as for products which are exported. However, the Panel held that other factors such as prevailing conditions of competition, existing relationship between price and cost, etc. must be examined in order to determine how a producer/exporter can enjoy the benefit of the decreased costs differently in each market. [see endnote 3]

Rejection of actual cost reflected in the records of the exporter

Article 2.2.1.1 of the Anti-dumping Agreement provides that costs shall ‘normally’ be calculated on the basis of records kept by the exporter or producer under investigation, provided that such records are in accordance with the generally accepted accounting principles of the exporting country and ‘reasonably reflect the costs’ associated with the production and sale of product under consideration. In EU- Biodiesel [see endnote 4] , the EU commission decided to disregard the actual recorded cost of soybean to calculate the cost of production of biodiesel because those costs were found to be artificially lower due to the distortion created by the Argentine export tax system. The Appellate Body observed that costs being ‘artificially low’ due to an existing export tax system was not a valid reason to determine that the costs were not reasonably reflected. It further held that the EU Commission was obligated to rely on the records maintained by the producers.

The Panel observed that, unlike the decision by the EU Commission in EU-Biodiesel, rejection of cost by ADC was not because it was not ‘reasonable’ but because ‘cost of producing pulp was substantially less than the competitive benchmark’ [see endnote 5]. The Panel further acknowledged that because of the use of work ‘normally’ in Article 2.2.1.1 there may be situations where the exporter records may need to be rejected despite them being (i) in accordance with the generally accepted accounting principles of the exporting country and them (ii) reasonably reflecting the costs associated with the production and sale of the product under consideration. However, the Panel still considered ADC decision as inconsistent with Article 2.2.1.1. It observed that the ADC did not examine, in accordance with Article 2.2.1.1, whether costs of exporter were GAAP consistent and reasonably reflected costs associated with the production and sale of A4 copy paper.

- the domestic price of A4 copy paper was affected by government intervention that distorted costs and prices; and/or

- the “particular market situation” meant that the domestic price of A4 copy paper was fixed in a manner incompatible with normal commercial practice; and/or

- the “particular market situation” meant that the domestic price of A4 copy paper was fixed according to criteria which were not those of the market-place.

Conclusion

Australia’s rejection of exporter’s cost has been considered as inconsistent with Article 2.2 and Article 2.2.1.1 of the Anti-dumping Agreement but the critical issue regarding the use of ‘particular market situation’ provision, which formed the basis for the complaint by Indonesia, still lacks clarity. Interpretation of the term ‘Particular market situation’ by the Panel is overly broad and ignores relevant ‘context’ under Article 2.2 and also conflicts with requirement in Article 2.2.1.1. as interpreted by the Appellate Body in EU-Biodiesel.

The Panel has ignored the language of Article 2.2, which clearly states that ‘particular market situation’ should exist in relation to the ‘sale’ of the like product in the domestic market. Distortion of input costs as a result of government action does not directly affect the situation of ‘sale’ of the upstream like product as such. The Panel has also ignored that the other two possibilities permitting rejection of normal value under Article 2.2 are regarding (i) ordinary course of trade & (ii) low volume of sales, which have very specific meaning directly in relation to the sale of the like product.

Thus, the term ‘particular market situation’ should also be limited in scope and should cover other such similar type of market situations, which directly affect domestic sales transaction prices but are not covered by the earlier two possibilities. [see endnote 6]

[The author is an Associate in International Trade Practice, Lakshmikumaran & Sridharan, New Delhi]

Endnotes:

- Panel Report, Australia – Anti-Dumping Measures on A4 Copy Paper (DS529), circulated 4th December 2019

- GATT Panel Report, EEC-Cotton Yarn, adopted 30 October 1995.

- The Panel stated that in the current factual scenario, the investigating authority should have considered the following to make a fair comparison:

- Panel Report, European Union - Anti-Dumping Measures on Biodiesel from Argentina (DS473).

- Panel Report, Australia – Anti-Dumping Measures on A4 Copy Paper (DS529), paras. 7.104 to 7.106. The distinction made by the Panel here is not obvious and is inconsequential. Rejection of recorded cost by ADC because it was ‘it was substantially less than the competitive benchmark’ effectively means that the cost was not ‘ideal’ or ‘reasonable’ in itself. In other words, it is hard to see how the determination by the ADC in this regard is different than the determination by the EU Commission under question in EU-Biodiesel.

- For example, sale of an unintended byproduct in the domestic market at extremely low prices may give rise to ‘particular market situation’ when export of such byproduct is under investigation.