The provisions relating to conduct of anti-dumping and anti-subsidy investigations in India are contained in the Customs Tariff Act, 1975, and the Customs Tariff (Identification, Assessment and Collection of Anti-Dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995 (‘AD Rules’) and the Customs Tariff (Identification, Assessment and Collection of Countervailing Duty on Subsidized Articles and for Determination of Injury) Rules, 1995 (‘CVD Rules’) made therein under.

The Directorate General of Trade Remedies (‘DGTR’) administers the AD and CVD Rules and also conducts anti-dumping/countervailing duty investigations. Though the AD and CVD Rules issued by the Central Government are intended to regulate the substance and the procedure of AD and CVD investigations, they are not exhaustive, and do not regulate every aspect of the investigation. In this regard, the DGTR from time to time, issues trade notices and office memorandums to streamline the AD/CVD investigation process.

The DGTR has recently issued a Trade Notice No. 04/2021 dated 16 June 2021 (‘Trade Notice’) to further streamline the process for AD/CVD applications filed by the domestic industry after 16 June 2021. This article intends to discuss some of the new requirements applicable under the Trade Notice.

Salient changes introduced by the said Trade Notice

By introduction of the Trade Notice, the DGTR has modified its checklist for applications being made by the domestic industry for initiation of AD and CVD investigations. The Trade Notice supersedes the DGTR’s previous Trade Notice No. 15/2018 dated 22 November 2018 (‘previous Trade Notice’).

The following are some of the main changes in requirements from the past as made out in the Trade Notice:

- The intervening time-period between the proposed period of investigation and the date on which the application is filed has been reduced from 5 months to 4 months;

- Where supporter’s data is not provided in compliance with requirements in Trade Notice No. 13/2018 (all the injury parameters), provision of a letter of support containing basic information (installed capacity, production and sales) in lieu of the same should be provided;

- For the normal value, a requirement to provide comparable representative price of the like article when exported from the exporting subject country or territory to the rest of the world including India as determined in accordance with the AD Rules, in case of absence of direct and other reasonably available evidence on domestic selling prices of the subject goods in the exporting country; and only in absence of all the said evidences the evidence of constructed normal value is to be provided.

- The requirement to furnish the installed capacity claims and project reports or any other similar document submitted to any Government agency/Financial Institution.

Of the above changes brought about by the Trade Notice, this Article will focus on two changes:

Gap between proposed Period of Investigation and Filing of Application

Given the elaborate exercise involve in preparation of data for the petition, there is expectedly a gap between the proposed period of investigation (‘POI’)[1] and the date on which the application is filed by the domestic industry seeking protection in the form of duties. However, in the interest of fairness, this gap should not exceed a particular length. Till 6 April 2021, the previous Trade Notice prescribed a gap of five (5) months. However, this was subsequently modified by Trade Notice No. 02/2021 dated 6 April 2021 to four (4) months. The DGTR has again confirmed this in the present Trade Notice.

It is possible that the above change was introduced in light of the provisions introduced[2] in the AD Rules during the Union Budget 2021 (Customs Notification No. 10/2021-Customs (N.T.), dated 1 February 2021) with respect to the POI. However, practically, there may be certain challenges for filing an application by the domestic industry within a span of 4 months due to the below reasons.

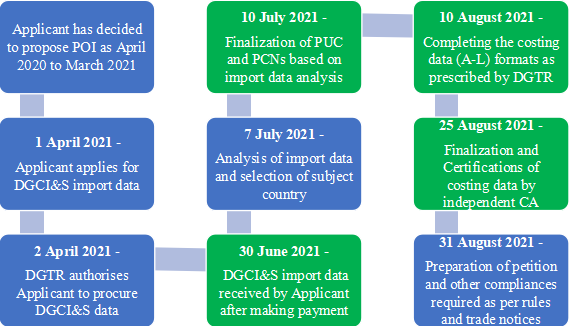

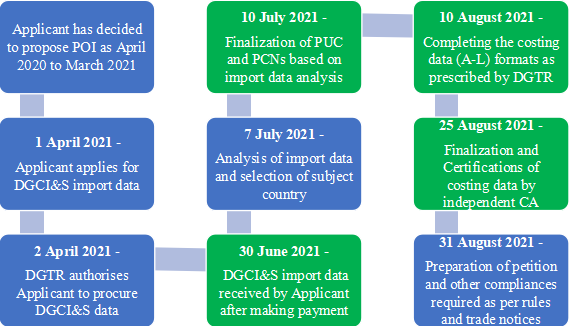

One of the basic requirements for filing either an AD or CVD application is the collection of transaction-wise import data from the Directorate General of Commercial Intelligence and Statistics (‘DGCI&S’). However, sometimes obtaining this data from the DGCI&S can take time. To explain this better, let us take the example of an application where applicant proposes a POI of April 2020 to March 2021. In this regard, the applicant is required to submit an application latest by 31 July 2021.

After all compliances and procedures prescribed in Trade Notice No. 01/2017 dated 8 December 2017 and subsequent trade notices, the applicant may eventually obtain the DGCI&S import data for April 2020 to March 2021 by the middle or end of June 2021. This leaves the applicant only about one month to complete the application, which is a very short time period for completing critical aspects of the petition such as import data segregation, its analysis to calculate the dumping and injury margins and price undercutting etc.

An applicant may require at least two months after receiving the DGCI&S import data to comply with all the requirements prescribed by the DGTR for filing an AD/CVD application. For ease of reference and better understanding, the hypothetical timelines in this regard can be seen below.

It can be seen from the above timelines that at least 5 months may be required to complete an application after complying with all the requirements stipulated by the DGTR. It is only when the complete written application is presented to the DGTR in the prescribed format, it is accepted and considered for initiation of the case.

It is also experienced that there can generally be a gap of 2 to 3 months for DGCI&S to compile the import data from all ports and provide it in the format required for AD / CVD cases. To assist the applicant in resolving such issues, the DGTR may consider requesting the DGCI&S to expedite its process of compiling transaction wise import data. The DGCI&S may also consider the time-sensitive nature of the investigation process and be requested to expedite providing the import data to the applicant.

Information from supporters:

The DGTR has prescribed a questionnaire for information to be provided by supporters vide Trade Notice No. 13/2018 dated 27 September 2018. This questionnaire seeks detailed information from the supporter on all the injury parameters. However, most often, the supporters are hesitant to provide the detailed information required for all the injury parameters since calculation of cost of production requires elaborate efforts. Instead, it is generally seen that the supporters merely provide one-page letter of their support or provide only limited information.

In order to streamline the participation of supporters in investigations, the Authority has now clarified in the Trade Notice that where the Trade Notice No. 13/2018 is not complied with, a letter of support containing some basic information such as installed capacity, product quantity, sales quantity and sales value for the injury period should be provided by the supporter.

Conclusion

The DGTR continues to play an active role in streamlining the trade remedy investigation process. Since 2017, the Authority has become more active in easing the process of filing AD/CVD applications and accelerating the proceedings as compared to the previous years. Within a span of almost three-years, the DGTR has issued 30 Trade Notices with regard to confidentiality, collection of import data, new application and questionnaire formats, request for change in name of producer(s) / exporter(s) in AD / CVD investigations, introduction of online platform ‘Artis’ for filing the applications, methodology regarding various forms of duty, timelines for sunset review investigations etc. Apart from this, the DGTR has issued Manual of Operating Practices for trade remedy investigations capturing the standard practices/procedures with respect to the trade remedy investigations conducted by India. Therefore, in the interest of a fair, transparent, smooth and effective investigation, the trade notices and manual by DGTR are a welcome step for the domestic industry as well as all the interested parties in the trade remedy investigations.

[The author is Senior Associate in WTO and International Trade practice team at Lakshmikumaran & Sridharan Attorneys, New Delhi]

- [1] The period for which data is examined by the Authority in any investigation, and for which period the dumping margin, injury margin, etc. is calculated.

- [2] (3A) The period of investigation shall, - (i)not be more than six months old as on the date of initiation of investigation; (ii)be for a period of twelve months normally and for reasons to be recorded in writing, the designated authority may consider a minimum of six months or maximum of eighteen months.