Goldman Sachs backed Renew Power - one of India’s largest renewable energy companies, finally announced overseas listing through SPAC after long drawn discussions on raising funds through asset sale or listing through an IPO in India.

Investors are increasingly interested in raising funds through SPACs post Renew’s announcement of its landmark deal with RMG Acquisitions Corporation II.

Understanding SPACs

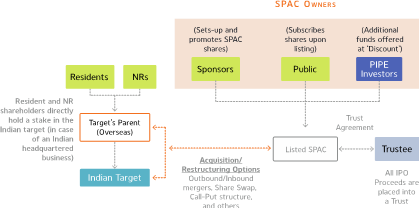

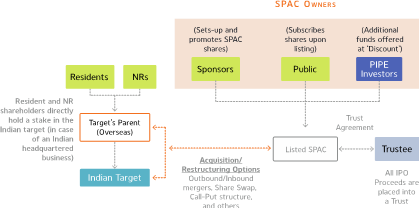

Special purpose acquisition companies (“SPAC”) are companies that have no business operations of their own, and are incorporated solely to raise capital through an initial public offer (“IPO”). Its investors include renowned private equity funds, hedge funds and other institutional investors. These companies have become quite popular among corporates for fund-raising. A SPAC offers securities for cash, and places all offer proceeds into a trust or escrow account for acquisition of potential targets in the future.

The usual lifecycle of a SPAC runs for two years, to identify and acquire a potential target but sometimes may extend to three years.

SPACs are not new. They evolved during the 1990s in the USA and were seen especially in industries such as media, retail, technology, healthcare and telecommunication, attracting interest from institutional investors.

Investors in SPACs are reputed financial sponsors, PE funds and VC funds, who have a huge capital base to invest in specific sectors. Generally, SPACs are formed to acquire a particular target but can also acquire multiple targets, if feasible.

Click here to read more